The marketplace for yen bonds from international corporations is warmer than it’s been in years, offering cash managers with an oasis as charges volatility soars.

Article content material

(Bloomberg) — The marketplace for yen bonds from international corporations is warmer than it’s been in years, offering cash managers with an oasis as charges volatility soars.

Commercial 2

Article content material

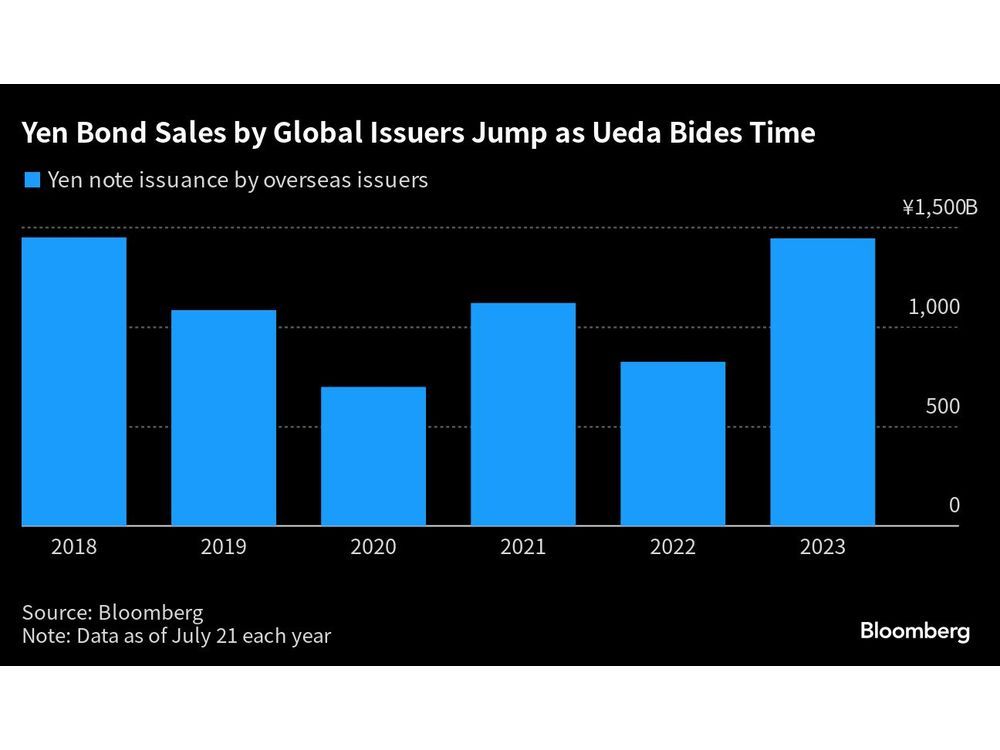

Buyers have scooped up yen debt from issuers outdoor Japan, fueling the busiest July since 2018. Offers have integrated Canada’s Toronto-Dominion Financial institution, Korea Funding & Securities Co. and France’s BPCE SA, which priced the largest institutional providing since 2019 within the Samurai marketplace.

Article content material

That’s introduced the tally for the reason that get started of the fiscal yr on April 1 to ¥1.44 trillion ($10.2 billion), essentially the most in 5 years. And there’s extra within the pipeline: Korean Air Traces Co. plans to factor a yen be aware this week, whilst that country’s executive intends to promote its first yen bond in Japan later this yr.

The securities on moderate are outperforming their native friends, when all yen company notes have made 1.2% to this point this yr, the most productive returns for that length since 2012.

Article content material

Commercial 3

Article content material

That’s all serving to burnish the asset magnificence at a time when charges markets are signaling expectancies that the Financial institution of Japan would possibly wish to tweak coverage as inflation stays above its goal, at the same time as Governor Kazuo Ueda has again and again made the case for keeping up financial stimulus. Nonetheless, BOJ officers see little pressing wish to act at the results of yield curve keep an eye on for now, other people aware of the topic stated ultimate week.

Every other enchantment is wider spreads when compared with Eastern issuers, to atone for native traders having much less research at their fingertips at the international debtors. That’s regardless of the corporations regularly having related or higher rankings.

“In a foreign country yen bonds are a sector that experience a bigger unfold cushion than home notes,” and so could be much less suffering from any alternate to YCC, stated Haruyasu Kato, a fund supervisor at Asset Control One. Kato has bought yen notes of non-Eastern issuers this yr.

Commercial 4

Article content material

Yen belongings have contended with volatility lately, with the Eastern forex surging and the 10-year executive bond yield shifting towards the BOJ’s ceiling. However thru all of it, in a foreign country issuers have saved tapping the marketplace and bankers see no let-up forward.

“Momentum to faucet the yen marketplace is powerful as spreads are moderately strong at a low stage,” stated Masahiro Koide, joint head of the goods trade department at Mizuho Securities Co., the most important underwriter of in a foreign country yen bonds in 2023. But when the BOJ had been to tweak its yield-curve keep an eye on, inflicting a bounce in yields, that can stay traders at the sidelines for a length, he stated.

Buffett’s Approval

For now, a part of the enchantment of promoting yen bonds for some issuers has been the higher beauty of Eastern belongings because the BOJ has to this point caught with its accommodative financial coverage, even because the Federal Reserve and Eu Central Financial institution have tightened. For different debtors, the significance of diversification of investment channels has performed a key function.

Commercial 5

Article content material

Warren Buffett led to a media flurry when he visited Japan in April to fulfill with company executives as Berkshire Hathaway Inc. used to be advertising yen debt. The corporate, which has change into the most important in a foreign country issuer of yen notes since its debut deal in 2019, stated in June it higher its holdings in Eastern buying and selling properties after the bond sale. Buffett isn’t by myself in having a bullish outlook for Eastern belongings, with the country’s shares soaring close to a greater than three-decade top.

Berkshire’s five-year be aware offered this yr had a discount greater than 3 times than on a similar-tenor Toyota Motor Corp. bond priced the next month. America company has upper credit score ratings from S&P World Rankings and Moody’s Buyers Carrier.

Extra yen bond gross sales have come as “higher volatility because of the speedy upward push in rates of interest ultimate yr had a significant have an effect on at the issuance setting in in a foreign country bond markets,” stated Noriaki Nomura, head of debt capital markets department at Mitsubishi UFJ Morgan Stanley Securities Co.

—With the aid of Ayai Tomisawa, Takahiko Hyuga and Daedo Kim.

Feedback

Postmedia is dedicated to keeping up a full of life however civil discussion board for dialogue and inspire all readers to percentage their perspectives on our articles. Feedback would possibly take as much as an hour for moderation prior to showing at the website online. We ask you to stay your feedback related and respectful. We’ve enabled e-mail notifications—you’re going to now obtain an e-mail in case you obtain a answer on your remark, there’s an replace to a remark thread you observe or if a person you observe feedback. Talk over with our Group Tips for more info and main points on the right way to modify your e-mail settings.

Sign up for the Dialog