[ad_1]

Bloom Cash, a U.Okay.-based fintech, has raised £1 million to digitize a casual monetary control device hired by way of ethnic communities the world over.

Continuously known as “rotating financial savings and credit score affiliation” (ROSCA), the microcredit device varies in the main points all over the world, however normally, it comes to a casual amassing of other folks from a definite network who act as a financial institution, amassing and saving cash that individuals can withdraw. The device is known as other names the world over, akin to “hagbad” in Somalia or “pardna” in portions of the Caribbean.

The purpose is to steer clear of typical banking methods, a lot of which discriminate in opposition to minority communities, particularly within the U.Okay., CEO Nina Mohanty stated. “A few of it is only blatant racism. We don’t have transparent red-lining like within the U.S., however there are indisputably postcode look-ups,” she stated.

The ROSCA device is a method to habits monetary issues with other folks you agree with, she stated, “whether or not this is by way of race, nationality, we’ve even were given other folks right down to the tribe stage.” Bloom Cash desires to digitize this ROSCA procedure.

A daughter of 2 immigrants to the U.S., Mohanty says she determined to paintings in this downside after she moved to the U.Okay. and discovered for herself simply how tough it may be for an immigrant to set themselves up financially. “I simply felt that there was once now not simply an financial justice level to this, but in addition an enormous alternative, the place other folks most effective call to mind the U.S. as a rustic of immigrants, however more and more throughout Europe, we all know migration is rising,” she stated.

Her co-founder and CTO Dan James believes within the device as a result of he’s observed how efficient it may be, rising up in an ethnic network in central Birmingham. “I noticed first-hand the advantages that the usage of ROSCAs can deliver other folks, particularly the ones getting into the U.Okay. who’ve traditionally been underserved by way of the present monetary sector,” he stated.

The corporate will use the budget from the pre-seed spherical to proceed development its virtual financial savings options, which has all budget safeguarded by way of an digital cash establishment. The fundraising was once led by way of Zinal Enlargement, and noticed January Ventures, Pact VC, and angel traders Berenice Magistretti and June Angelides collaborating.

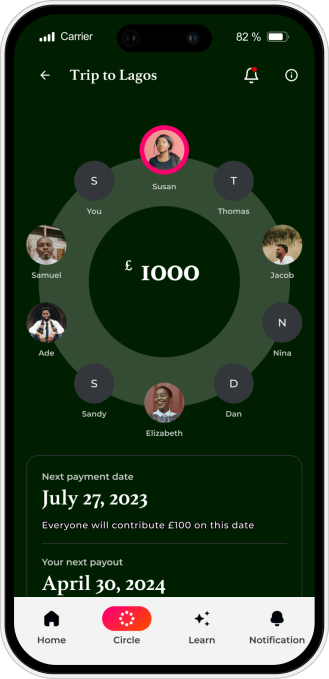

Bloom Cash shall we other folks create teams, referred to as Bloom Circles, to percentage and lower your expenses with. It additionally has instructional fabrics at the fundamentals of existence within the U.Okay., akin to the best way to get a driving force’s license, putting in a agree with fund, and an explainer on credit score rankings.

Mohanty described the fundraising procedure as “in point of fact attention-grabbing.” She stated essentially the most difficult phase was once explaining to traders that the corporate meant to focus on very underserved communities. In the beginning, there was once numerous false impression, she stated. “Some very racist, xenophobic issues have been stated to us,” she stated. “Even going in the course of the legislation procedure, there was once numerous prejudice that we had to conquer.”

Mohanty and James say they sought after ethnic and gender range on their cap desk, and so they appear to have controlled that to this point: just about 70% in their cap desk identifies as girls, nearly 50% comes from a minority ethnic background, and about part determine as first or second-generation immigrants.

Angelides, an angel investor, stated Bloom Cash was once her first angel fintech funding, and he or she knew proper off the bat how large of an issue the corporate is making an attempt to resolve since she grew up in Nigeria, the place money is king. “Communities have struggled for generations with agree with in monetary methods and feature most well-liked to make use of community-based saving strategies, akin to Ajo (the Nigerian model of the ROSCA device).”

“This comes with its personal set of issues, from other folks absconding with budget to other folks being not able to seriously develop wealth. That is the place Bloom Cash is available in,” Angelidas added. “A large number of migrant communities remit huge quantities to their house nations each and every yr. With Bloom, they now even have a chance to construct more potent ties with the U.Okay., develop their wealth and qualify for added merchandise that they ordinarily would have struggled to get admission to.”

[ad_2]