[ad_1]

Zanyar’s dream of a existence past his place of birth Zurkan, close to Ranya, Iraq, price his circle of relatives €11,000, his father’s land and, in the long run, price him his existence.

In keeping with an area migrants’ affiliation, between 2020 and 2021 on my own, over 56,000 other people from the Kurdistan area of Iraq determined emigrate because of geopolitical instability and loss of alternatives – 20-year-old Zanyar used to be one among them.

“Zanyar dropped out of faculty,” Mustafa Mina Nabi, Zanyar’s father, recounts as he tended to the roses in his lawn outdoor his cement-made house in Zurkan. “He stated that others who graduated couldn’t discover a process both. And with no process, how used to be he going to calm down, get married, get started a circle of relatives?”

Zanyar sought after to succeed in the United Kingdom and identify himself as a barber. However his dream got here to an finish within the chilly English Channel, on a stormy day in overdue November 2021.

Zanyar used to be a few of the two dozen other people in quest of safe haven in the United Kingdom who died of hypothermia when their dinghy sank while looking to pass from northern France to southern England. Attaining Europe and the UK by means of the abnormal path is not just tricky and perilous, but additionally extraordinarily pricey.

The absence of prison migratory routes has created industry alternatives for legal networks. It has additionally greater the function of an off-the-cuff banking gadget that works thru “hawala”, a millenia-old conventional cash switch gadget in accordance with interpersonal accept as true with.

This joint investigation, performed over 2022 via a crew of six reporters, exposes how tightening migration insurance policies have led to migrants to fall prey to unscrupulous smugglers, and accept as true with hawala as the one method to mitigate the danger of being scammed.

Hawala: a gadget in accordance with accept as true with

On a chilly morning in overdue November 2022, in Erbil’s Cash Exchangers Marketplace, referred to as the “US Greenbacks Bazaar” within the capital of Iraqi Kurdistan, distributors transfer round with blocks of banknotes the dimensions of an old style TV field.

Males shout out huge sums of cash – US greenbacks, Iraqi dinars, Syrian kilos – which they provide to interchange to the very best bidder. Cash repeatedly switches between arms.

Obtain the most productive of Eu journalism instantly on your inbox each Thursday

Dozens of money-order places of work populate the streets, corridors, and basements of the bazaar. Some paintings with Iran, and others ship cash most effective to Germany and France. Some have companions everywhere Europe, whilst others declare they may be able to ship cash to any nation on this planet. However, as a substitute of the standard channels of global banking, many use the “hawala” gadget.

In Turkey, the hawala is continuously run thru an change cash workplace. In Greece, the hawala dealer will also be the landlord of a mini marketplace or a store promoting cellphones. In Belgium, it may well be any of the 3 choices.

A hawala dealer’s workplace will also be so simple as a table and a chair, a cell phone, a cash counter device, and a secure field. A pocket book additionally turns out to be useful to stay observe of money owed.

There’s no SWIFT or blockchain gadget to report transactions, nor do hawala agents supply any roughly receipt that secures the debt. The gadget is based basically on accept as true with, Gözde Güran, an assistant professor at Georgetown College, explains. “By way of knitting in combination other accept as true with relationships, hawala agents are in a position to concurrently use the accept as true with to ensure their mutual duties and prolong their protection throughout more than one places.”

In terms of smuggling, there’s a additional receive advantages. To supply promises of passage to other people at the transfer, hawala agents pay out the reserved sum to smugglers most effective after they’ve effectively reached their vacation spot.

A hawala dealer “would now not damage his recognition” via swindling a migrant, says Mustafa, Zanyar’s father: “Right here we’re from the old fashioned. If he did one thing like that, no person would do industry with him once more.”

In Zanyar’s case, the hawala dealer refused at hand the cash over to smugglers after his dying and as a substitute returned it to his circle of relatives; small reimbursement for the lack of their liked son.

The emerging significance of hawala for migration

The gadget is as outdated because the Silk Street, when it used to be used to facilitate bills between traders, combating them from wearing huge sums of cash on their lengthy trips.

These days, cash transfers thru hawala are in particular common around the Heart East and South Asia. For lots of migrant communities, it is usually an ordinary gadget for sending remittances house, particularly to international locations like Iran and Afghanistan, excluded from the worldwide monetary gadget.

Whilst commissions of businesses comparable to Western Union or Moneygram can achieve as much as 15%, hawala agents fee anyplace between 2% and 10%. From time to time “it could also be 0%”, explains a hawala dealer from Erbil, if the switch asked is helping settle a debt in an cope with the place now not many shipments are normally made.

The gadget could also be now not new to the fee of migration routes which, consistent with estimates in accordance with information from UNHCR, Europol, the Eu border company Frontex, and professional reviews, usher in a collective annual turnover between €300 and €700 million.

Over one million other people arrived in Europe in 2015, in what has been recorded as the height of the ‘refugee disaster’. Europol estimated that part had paid for his or her adventure in money; the remaining via quite a lot of strategies, together with hawala.

For lots of migrants, that is the one devoted gadget to make bills because it supplies safety and stops being cheated via smugglers or robbed via criminals or border guards. “No one carries large sums of cash in this day and age,” a intermediary who connects migrants and smugglers defined from his go back and forth company within the middle of Ranya, in Iraqi Kurdistan. “It’s a carrier… The most efficient one so [as to ensure that] a minimum of other people aren’t scammed.”

He used to be additionally at the transfer as soon as in 2005, when he traveled irregularly to Denmark and spent years there till he determined to go back house. He then began to take part within the profitable industry of human smuggling.

The rise in pushbacks, throughout other border crossings of the go back and forth, has made the hawala agents’ insurance coverage function much more vital. Because it turns into tougher to pass borders, they promise to not pay out till a vacation spot is reached, which supplies important safety.

Maximum of them belong to the similar group as the folks at the transfer, consistent with professional Güran. “Consumers in most cases in reality need to pass to the individual from their nationality, even place of birth if imaginable. They usually all the time categorical such a lot mistrust against agents from different international locations,” she notes.

From time to time hawala is known as a “shadow banking gadget”. However consistent with Güran, that will depend on how executive and prison government view it. “I keep in mind that governments are nervous about unregistered people accomplishing cash transfers as a result of this doesn’t are compatible into their surveillance safety paradigms of these days and they aren’t in a position to track those transfers, which will achieve important quantities,” she stated.

“On the other hand in lots of contexts, it’s the most effective gadget other people know as a result of there’s no different method to pay providers or finance any roughly operation,” she added.

The street begins on WhatsApp and Telegram

Smugglers use WhatsApp and Telegram to put it up for sale their products and services and achieve the accept as true with of other people at the transfer. Over the process this investigation, the journalists joined 13 Telegram teams the place smugglers hook up with migrants.

The teams supply knowledge on costs, information about the fee, and get in touch with numbers the place one can name for additional info. Messages are normally deleted inside a couple of days.

Directors referred again and again to “codes” and “deciphering”; a connection with the passwords used to free up cash at a hawala dealer when a checkpoint alongside the adventure is reached. One smuggler promised: “We’ve a method to Serbia thru Bulgaria. 5 hours stroll to the charging level […] In case of fingerprinting in Sofia, code deciphering XXXX.”

The place is the cash?

As soon as gained via smugglers and hawala agents, there’s no method to observe the cash, making the gadget recommended to cover illicit income from government.

Alaa Qasim Rahima, referred to as “Abu Al Axe”, a Kurd born in Iraq in 1984, is aware of it neatly. When he used to be residing in a refugee camp within the Netherlands, Abu Al Axe used to promote meals in a “black marketplace”. In a while, he moved to Italy and began to paintings as a smuggler: he may just make preparations for other people to pass the Balkans or Italy to succeed in France, Germany, or different locations via merely the use of his smartphone.

Now, as he sits detained in an Italian jail, status trial for allegedly smuggling migrants from southern Italy to the remainder of Europe, investigators have now not been in a position to place their arms on his “treasure”.

“For every migrant, I requested for round €500-€600. The sums have been deposited with businesses in Turkey, the place they nonetheless are,” he defined, in November 2022, prior to his trial. He claimed his cash in Turkey quantities to just about €300,000.

“Contemporary police investigations have highlighted the essential function performed via [the agencies] in favoring unlawful immigration against the international locations of the Eu Union. No longer most effective do they observe the so-called Sarafi (or hawala) means, but additionally act as ‘businesses’ for the recruitment of migrants keen to succeed in Europe,” the Guardia di Finanza (the Italian regulation enforcement company coping with monetary crime and smuggling) writes in a document.

The investigators additionally underline every other facet: “The landlord of the businesses chooses the most productive organised and maximum dependable smuggler” as a result of “most effective the a success consequence of the switch of migrants promises the hawala dealer the number of the chances at the charges because of the smugglers.”

Hawala’s obscure prison standing

In respond to a parliamentary query on July 31, 2020, Valdis Dombrovskis, EU Government Vice-President chargeable for an Economic system that Works for Folks, mentioned: “Throughout the Eu Union, those who function hawala, like any operators offering fee products and services, must be licensed fee establishments, as it should be registered and controlled.”

Within the EU the gadget is illegitimate, however in some international locations, like Italy, purchasers aren’t penalized – however hawala agents are. In others, like the United Kingdom, some hawala agents are registered and controlled, whilst others function out of sight of the regulation.

“We should watch out not to provide the hawala as a criminality as a result of, in some international locations like Austria, it may be prison if you happen to sign in with the government. No longer many do sign in although, and so they won’t know in regards to the requirement to sign in,” says Dr. Claire Healy, coordinator of the Observatory on Smuggling of Migrants, established via the UNODC, who is operating on analysis in regards to the “abuse” of the hawala gadget via migrant smugglers. The researchers interviewed 113 hawala agents in 30 international locations (in Asia, Africa, Europe, and North The usa).

In October 2022, the second one day of the “greatest assembly ever of prosecutors who focus on tackling migrant smuggling,”( as its organizers, the Eu Union Company for Felony Justice Cooperation outlined it), used to be devoted to the monetary streams in the back of migrant smuggling teams, together with “the usage of the opposite hawala.”

In a document, the Monetary Motion Job Pressure (FATF) – the worldwide cash laundering and terrorist financing watchdog – issues out that hawala is “the most typical means of moving finances (continuously money) generated from migrant smuggling,” including that this makes it “extraordinarily arduous for Monetary Knowledge Devices and Regulation Enforcement Businesses to accomplish monetary research and investigations.”

There are lots of causes. “Monetary flows are continuously channeled by means of hawala, and typically from and to international locations with restricted capability or revel in in accomplishing cross-border monetary investigations,” the document states.

Additionally, other people arrested for smuggling comparable to drivers “also are normally not able to supply any knowledge.” Identical to when it comes to Abu Al Axe, “finances that aren’t seized right through investigation stay out of achieve.”

Hawala agents would be the bankers

On a chilly and damp January morning in 2023 in Grande-Synthe, a coastal suburb of the French town Dunkirk, refugees look ahead to an opportunity to pass the English Channel.

In a cluster of blue and white tents that line a railway line, Aisha* and her two little daughters huddle in combination round a fireplace close to the observe, looking to stay heat. She plans to pass the Channel quickly, hoping to sign up for her husband who has already carried out for asylum in the United Kingdom.

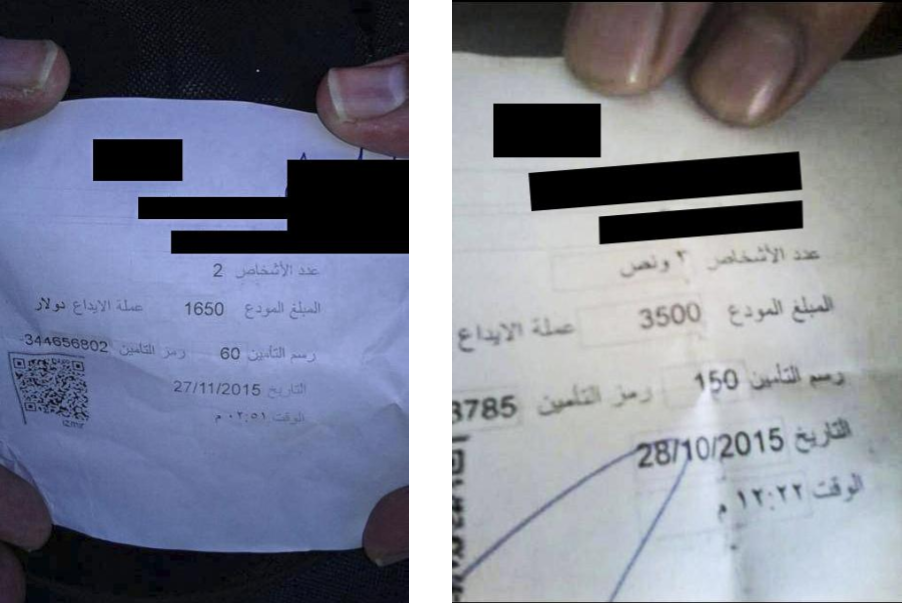

To this point the adventure – from Iraq to Turkey on a vacationer visa, then during the Balkans, to Croatia, and France – has price €4,500 for the 3 of them. Aisha expects to spend every other €1,500-€2,000 to pass to the United Kingdom via boat. Her father paid for the adventure by means of a hawala dealer in Iraq. “With each border I’ve crossed, I ship my father a WhatsApp message with my location and he indicators the Nosinga (a Kurdish phrase for the hawala dealer) in order that bills will also be made to the smuggler,” she stated.

“I’m a journalist and fleeing as a result of I used to be being focused for my paintings again house,” she stated.“I couldn’t get a visa to come back to Europe legally and feature needed to search safe haven thru this bad path the place the smugglers are ruthless.”

“Since we don’t give you the option to come back legally and wish safety, hawala is what we need to hotel to,” says Goran, a 19-year-old Iraqi-Kurdish guy who could also be ready in Dunkirk.

A Kurdish guy from Iran joins the dialog: “The EU must take motion to switch this via giving extra visas. Even though they attempted to take on hawala, other people will nonetheless have the opportunity to pass.”

Whilst Eu and global police government are looking to know the way the hawala gadget works with a purpose to take on smuggling, for the 1000’s of other people at the transfer making their means throughout Europe, hawala’s legality is inappropriate. And as smuggling stays the one go back and forth path, hawala agents can be its bankers.

*Some names were modified.

👉 Authentic article on Solomon

[ad_2]